Pair trading with options

In detail about pair trading. Pair trading options are an effective way to trade various assets for a profit. To learn more.

What are pair options and what is pair trading

Pair trading options is a simple and direct way to trade in relative performance of stocks and profit by predicting which stock within a given stock pair will perform better (e.g. the pair Google vs.Yahoo). If you selected the better performer you will receive a payout. The payout is shown when you place a trade and varies with the pair, option type and market conditions. Payouts can be as high as 350%. Pair Options are options, so you are paid only if you selected the better performing stock.

Benefits of pair trading

One of the unique benefits of pair trading is that you do not need to worry about the general market movements. You can profit even when the market goes down, because only the relative performance between stocks – which ones under-perform and which ones out-perform – have an impact on the pair option value. Even if the stock you chose went down, the only thing that matters is how the other stock performed, and if it decreased further, your pair option will be in the money.

For example:

For the pair Vodafone / British Telecom you open a fixed pair option trade of $100. You picked Vodafone to be the better performer by the end of the day. The option is set to return 82% if Vodafone performs better.

Relative performance is measured for each stock from the time you placed the trade (option start).

If Vodafone is the better performer, your option expired "in the money" and your payout is $182 ($100 initial trade + $82 return).

If British Telecom is the better performer, your option has expired "out of the money" and you don't get a payout.

With pair options, you don't have to wait until the expiry since it enables closing a position before expiry.

A pairs trade involves two separate, yet related, option plays - one bullish, and one bearish - on two different underlying securities. While it can certainly be classified as a "hedged" strategy, a pairs trade is not a direct hedge in the way that a protective put shields against losses in a stock position.

Pair options are unique and offer significant benefits to pair trading investors:

1. Pair options are market neutral, meaning that you can make a profit even when the market goes down.

2. Pair options are based on comparison, and only the relative performance counts.

3. Pair options give you complete flexibility: you can open or close your position at any time. You can exit and take profits or cut your losses.

4. Pair options pricing is transparent: no hidden costs, absolute loss cap limited to the option price, payouts are shown continuously and are updated during market trading hours.

Two types of pair trading options: fixed and floating:

Fixed pair options are options in which the better performing stock is determined by the stock pair's relative performance from the time the option was purchased (start time) to the time of expiry.

Floating pair options are options in which the better performing stock is determined by the stock pair's relative performance during a predefined period in which the trade took place (a day, a week or a month). Relative performance is measured from the beginning of this period (in contrast with fixed pair options which is from the time of trade). The payout time is always the end of the day, week or month.

Trading in fixed pair options:

Fixed pair options let you determine the option's expiry time when you open a position (i.e. an hour, a day, a week.) Fixed pair options close at a fixed expiry time.

Option start time: for each stock pair, the relative performance of each stock is measured from the time you purchased the option. This is also called the option start time.

Option expiry time: option expiry can be set to any time between one hour and 150 days from purchase.

Payouts can be as high as 86% and are indicated at the time of trade. Payouts are determined depending on the relative position of the underlying stocks and other market variables.

Fixed pair option example:

For the pair Vodafone / British Telecom you opened a trade of $100, predicting that Vodafone will be the better performer at the end of the day. The option terms set a payout of 82% if Vodafone performs better.

Relative performance is measured from the time you placed the trade (option start).

At the end of the day (option expiry), relative performance is measured for the two stocks, neutralising the effect of market movements throughout the day.

If Vodafone is the better performer, your payout is $182.

If British Telecom is the better performer, your payout is zero.

Position close: pair options let you close your position before the option's expiry time (during trading hours). When your positions are open, you will see the payout offered by the platform. If you close the position "sell" it will payout the indicated value.

Trading in floating pair options:

Floating pair options are contracts by which the better performing stock is determined by the stock pair's relative value at a predefined date and time (usually beginning of a day, a week or month). The better performing stock is determined by the difference in value between the opening and the closing of your ownership.

Payout is at the set expiry time: end of day, week or month. When market trading is open, the platform shows a payout value in real time. You can close your position at a profit while trading is open (before the original expiry time).

Option start time: a floating option starts at the beginning of the trading period: day, week or month. Option start time is fixed regardless of your trade start time. Your position value has to "catch up" with the other stock when your side is below the other side. If your side is leading, it has to maintain its position relative to the other stock.

Option expiry time: floating pair options are available with option expiry at the end of the day, week or month.

Payouts can be as high as 350%: When you trade you will see a payout value in percentage at option expiry. Payouts are determined depending on time to expiry, the relative value of the underlying stocks and other market variables.

Position close: pair options let you close your position before the option's expiry time (during trading hours). When your positions are open, you will see the payout offered by the platform. If you close the position "sell" it will payout the indicated value.

Floating pair option example:

At midday, you opened a $100 trade on the Apple / Microsoft pair option. You speculate on Apple outperforming Microsoft at the end of the day. At the time you opened the trade, Apple was BELOW Microsoft and the payout of Apple outperforming Microsoft at the day's end was 350%.

Relative performance is measured from the beginning of the day, which is the option start time. Not your trade opening time.

If at the end of the day (option expiry time) Apple outperformed Microsoft, your payout will be $450. Otherwise, it will be zero.

You can close your position before the expiry time. If two hours after placing the trade, Apple outperformed Microsoft you can close the position with a payout of $210. At that time, platform payout was 110%. In this case, the payout was determined according to position close, at 2 PM.

Learn more: for further information check out our examples and guide. If you are ready to get started you can open trading account in minutes.

Pair options trading

Option pair is different from the average CFDs, Forex and options. The main role of assets took stocks, indexes, and commodities. This pairs options trading is unique and does not offer any currency pairs to predict.

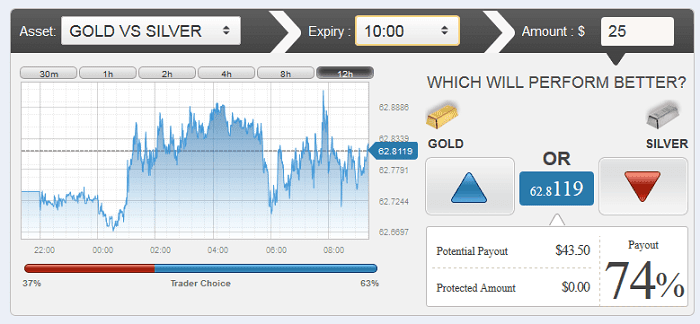

This option is short-lasting and its time runs out in 30 or 60 minutes. Trader's goal is to make a profitable forecast. Unlike any average option, in pairs, the prediction should be made on increase or decrease position. Assets result is influenced by its growth. For example, in GOLD / SILVER pair growth a trader should make a forecast on that asset, that in his opinion will grow faster. The smallest investment amount on pair option is 20 dollars, the largest – 2500 dollars.

Advantages of pair options trading

Income from trading paired options can reach up to 82% of the investment amount.

A paired option can be sold, doubled and extended.

Asset - By pressing button "asset" you will open the whole list of available assets. Choose the correct one to open the movement schedule and make a deal.

Expiry - Choose the option's expiration time.

Amount - Choose the sum of investment.

Press "UP" if you think, that assets' price will increase over the strike price at the expiration time. Press "DOWN", if you think that assets' price will be lower than the strike's price at the expiration moment.

Flashing unit between buttons "UP" and "DOWN". This block is showing the price difference in real time. Green is growth, red is fall.

Expected payments - Depending on your decision making these are expected payments that you are going to receive by the end of the option.

Pay-out % - Option payout is %.

Remaining time - The time that is left until option's expiration.

Schedule view - It can be displayed in two ways: line and candle.

Reuter's schedule shows the assets' price movement.

Traders choice - Percentage indicator between trader's choice on the same asset.

Choose the period to know more about the assets' price movement.

Current pen positions.

Expired positions - Archive with expired positions.

Sell – function that allows closing option faster than it closes and returns some money from the deal.

Double up – function that allows investing in the asset by its current price.

Rollover – function that allows extending option.

See also:

Best options brokers

What is options trading

Best options trading assets

Options trading platforms

60 seconds options