What is options trading

What is options trading? Find out more. Trading with options provide a venue for traders to speculate on the market movement of asset prices. Opening positions are executed with very simple terms, a Call trade where investors can profit from an increase in prices; and opening a Put position, for declining asset values.

Advantages of options trading

Options trading is similar to trading over other financial instruments and it is always compared and contrasted with traditional trading. However, there are several notable advantages not previously available to traditional online brokers.

1) No commissions or broker fees. Compared with traditional online trading where broker fees and commissions are always a part of a trade, options trading will not cost you anything for fees and commission. Normally, traditional brokers will bill a very high premium just to buy one share of stocks. With options trading, the minimum investment amount that traders will spend is at least $10. And with trades finishing in-the-money, profits earned are immensely huge compared to your initial investment.

2) Variables. In regular trading, there are variables to be considered and each should be set accordingly if traders are expecting huge returns. To have a reasonable profit, assets should appreciate by a certain percentage. When you trade options, you only need to appreciate market values that are most likely to increase or decrease within a prescribed time period.

3) Investment amount. Traditional trading would require huge investment amounts to lock in trading profits. However, options traders can earn as much as 75%-92% of their small investment amount. Traders can magnify their gains, which makes trading with options friendly to small investors.

How to trade options

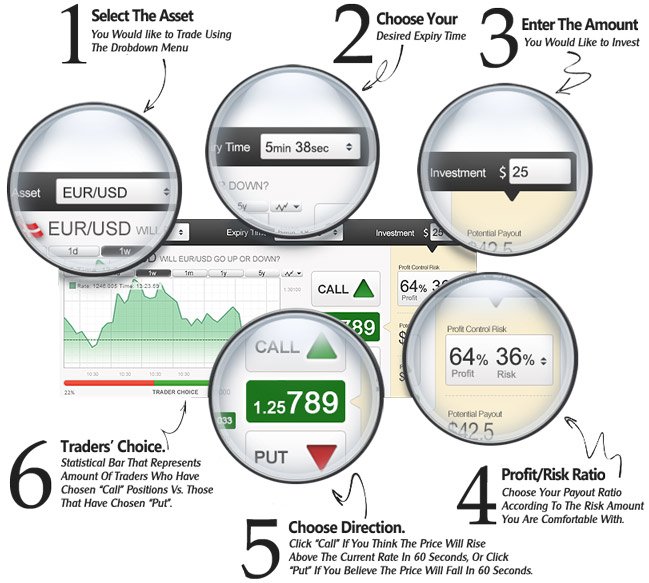

The process is relatively simple and can be broken down into four easy steps:

Select an asset. Each asset is different and has a dynamic nature. Choose one that you understand and restrict trading what you already know.

Analyze the direction of the asset. Using fundamental and technical analysis, speculate on which direction the asset prices are headed for. Other methods such as news research, earnings reports and dividends reports are helpful tools that you can use. If you anticipate that prices are likely to increase, then enter a Call trade. Enter a Put trade for declining prices.

Select appropriate timeframe. Your price forecast should be set within an appropriate timeframe for your predictions to be correct and earn profits. If you think that the asset prices of your chosen company will increase at the end of the day, then select one trading day as your expiry.

Specify the risk. Finally you are ready to specify the risk percentage of your investment size. There are high profits in options trading so identify the best combination of choosing the right options and set the position size accordingly.

Benefits of options trading

The main advantages of options trading. Learn more about all the benefits of options and apply them to your trading. Read more.

What are the benefits of trading options?

Most of the people from all over the world are interested to become options traders because of the ease and profitability of trading, simplicity, risk- controlled and a profitable way to trade. Most of them are satisfied with the quick nature of options, that makes you to earn just in a few minutes up to 80% of your original investment. Payouts are always set in advance and it means that if you follow the market news, you can enjoy a high return in the wink of an eye.

Benefits of options trading:

Simplicity

You can enjoy the simplicity of executing a trade, up or down. No special experience needed.

Lightness and flexibility

Options are available 24 hours even on weekends and holidays on a wide range of stocks, commodities, cryptocurrencies (Bitcoin), currencies and indices that you can trade on multiple timeframes.There is always an expiration time that gives new opportunities to traders.

Limited risk

You do not risk to lose more than you invested. You exactly know how much you lose or earn. That is why options have the lowest risk involved.

Predefined profits

There is a predefined payout percentage for your winning options trades. So, you know exactly the size of your profit before trading.

User friendly

Option platform is powerful and easy to use. You can enjoy the high speed and authenticity of your trades execution.

Mobility

You can easily trade options with mobile trading platform wherever you are. No need to worry about your transactions when you don't have a computer nearby, when you have a mobile phone.

Hedging opportunities

You can hedge other option positions that you have in the asset to prevent further losses.

Learn about options trading and investing

Options, also known as digital options, all-or-nothing options or fixed return options (FROs) are the fastest and simplest way to trade the worldwide markets today.

A option is a financial option in which the payoff is either some fixed monetary amount or nothing at all. The two main types of options are the cash-or-nothing option and the asset-or-nothing option.

Options became available as a method of investing in 2008 when the Securities and Exchange Commission (SEC) legalized the listing of options as tradable contracts on international financial markets. In 2012, they were officially deemed financial instruments by CySEC.

Options allow traders to predict the future direction of an asset such as stocks, commodities, indices, cryptocurrencies or currency pairs in the forex market.

In options trading, this means that you are making a prediction of whether the value of an asset will rise or fall over a set period of time. They are one of the simplest trading instruments and investors will have the outcomes of their prediction when the expiry time ends. There are two possible outcomes and the price of the asset does not matter. So what matters is if your prediction was correct or not. For example, if the price of gold is currently 1500, will it rise or fall by 5:00 PM today? As far as a trader is concerned, all that matters is if his/her prediction was correct or incorrect. If the investor prediction is correct, he/she will win a predetermined percentage of the amount he/she chose to invest. But if the investor prediction is wrong, he/she will lose the investment amount.

Options allow the 21st century investor to focus solely on what is important, the direction of the asset, without other complicating factors, and to enjoy exceptionally high returns for each correct trade. Options trading give you the opportunity to grow your investment like.

What are options, how to trade

Options allow traders to make a profit by predicting the future direction of assets such as stocks, commodities, indices, cryptocurrencies or currency pairs. The income in each winning transaction is up to 92%, which is the most effective way to trade in the financial markets. Learn more about options, fundamentals of trading and transaction forecasting to increase your investment. Read the complete guide.

In options the investors simply predict whether the value of an asset will rise or fall within a set period of time. They are one of the simplest trading instruments and investors will have the outcomes of their prediction when the expiry time ends. There are two possible outcomes and the price of the asset does not matter. So what matters is if your prediction was correct or not. If the investor prediction is correct, he/she will win a predetermined percentage of the amount he/she chose to invest. On the contrary, if the investor prediction is wrong, he/she will lose the investment amount. This is the opportunity that a Option gives you to grow your investment like the wind.

How to trade on options

Options are not complicated trading instruments. They are very simple and easy to understand. There is no matter if you are experienced or not, you can simply understand the trading strategies and process. You can trade assets such as stocks, commodity, indices, cryptocurrency or currency pairs in a trading platform with a variety of trading tools and properties.

In options, you are able to buy an asset in both directions of trade either by buying a "call" option or "put" option which are the basics. When the price of the underlying asset is expected to rise, a trader buys call option and If the price is expected to fall below the strike price, a trader buys put option.

A key to a successful option trading is that to make sure the asset in which you are investing your funds will move in the same direction of your prediction while paying attention to the expiry time and date of the underlying asset.

Such as forex, options are traded online. What enables you to have a benefit of option trading is an account with a trustable company.

Risk disclaimer: Trading in derivative financial instruments brings a high level of investment income, but is also associated with the possibility of losing your investment. Before bidding, it is recommended that you familiarize yourself with the terms of trade.

See also:

Best brokers for options trading

Types of options

Best options trading assets

Options trading platforms

60 seconds options

Student became a millionaire, earning on options

How to learn how to make money online trading