Long Term options

Advantages of Long-term call options. Long Term options is ideal for experienced traders who prefer to put their market knowledge to good use to trade at a wider timeframe. By taking into consideration the macroeconomic information and basic fundamental indicators, traders can have their positions open up to 1 year.

Long-Term calls

Long-term call options are frequently used as a replacement strategy for a long stock position as it offers long term upside exposure with limited risk. Calls should be used when there is a bullish outlook on the underlying stock or ETF for at least 2-3 months or greater.

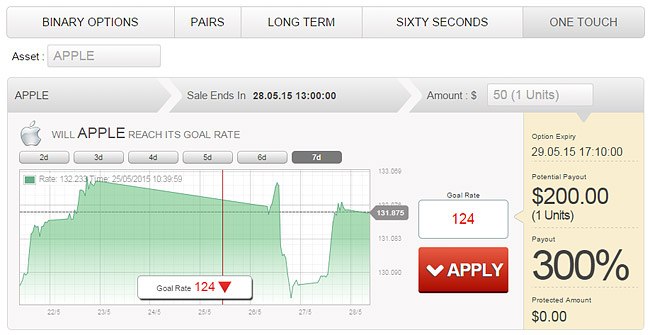

Long Term options involve predicting whether the market will rise or fall within a specified time.

The trading process is exactly the same for both short and Long Term options:

1. Select an asset and expiry time;

2. Specify your investment amount;

3. Predict whether the market will move up or down.

The difference of Long Term and short is that expiry time of assets for Long term options is not on the same day.

See Also:

Best options brokers

What is options trading

Best options trading assets

Options trading platforms

60 Seconds Options